There will be some major changes taking place in 2026 and I want to give you time to plan and prepare. Please read this fully and reach out to me if you have any questions.

Important Info Including:

- The changes regarding tax subsidies (financial assistance)

- Ensure you understand the “subsidy cliff” and how it impacts you

- Review your MAGI (Modified Adjusted Gross Income) for 2026

- Discuss next steps

Note: If you are not receiving a tax subsidy and/or you do not list your MAGI on your application, you can skip to “Next Steps”.

Changes Regarding Tax Subsidies

Tax subsidies (also known as Advanced Premium Tax Credits – APTC) are determined by the Modified Adjusted Gross Income (MAGI) listed on your application. If you enrolled in your 2025 health plan through Connect for Health Colorado, and your MAGI was within a certain threshold, the cost of your monthly premium was offset by a federal tax subsidy. These federal tax subsidies are now only available to individuals/ households in the newly reduced income brackets (similar to how it worked before the pandemic). Newly, Colorado will be offering a state tax subsidy (APTC) for qualifying individuals. (Further details on this in the next section.) Colorado will also be providing assistance to qualifying individuals through the Colorado Premium Assistance program (CPA). Please read to the end to see how you can find out your APTC and CPA qualifications.

Subsidy Cliff

The “Subsidy Cliff” will be returning in 2026. If your MAGI is under 400% of the Federal Poverty Level (FPL), you will receive a subsidy. Subsidies will be incrementally adjusted up to 400% FPL. However, for 2026 enrollments, there will be a subsidy cliff at 400% FPL. This means that if your MAGI increases above that threshold by the end of the year, even by $1, you will be required to pay back the entire subsidy you received in 2026.

From 2021-2025 there were caps on the amount of subsidy that needed to be paid back and the subsidy amount phased out slowly allowing individuals/families over the 400% FPL to also receive a subsidy to lower the health insurance cost. This has ended and we are going back to how it worked previously.

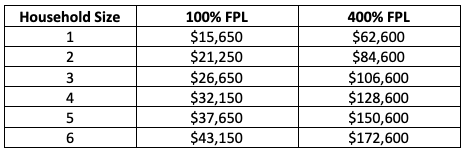

Here’s an example of annual income levels for 100% – 400% FPL for plan year 2026:

***PLEASE NOTE THAT WHAT’S CONSIDERED 400% FPL ALSO VARIES ON AGE AND LOCATION SO YOUR INCOME CUT OFF MIGHT BE DIFFERENT THAN SOMEONE ELSE’S

For example, a household with four members would need their MAGI to remain under $128,600. If it increased above that threshold, they would need to pay back the entire subsidy they received throughout 2026. Make sure you are working with a tax professional to determine an accurate MAGI for 2026 and account for any potential extra income. Will you be receiving a bonus? Investment income? Severance package? Other?

Also, keep in mind that the above numbers may not be finalized. Connect for Health offers a cost tool which you can utilize to determine your 400% FPL. (More on this in Next Steps.)

MAGI for 2026

I will need an accurate MAGI to list on your application for 2026. I need this whether or not you are making changes to your plan. Please work with your tax professional during this time to determine your MAGI for 2026; I am unable to advise on this in any way. Also, keep in mind that Connect for Health is frequently requiring income verifications. Please be prepared to provide this documentation or be willing to sign an attestation of your income if requested. I hope you can take the next couple weeks to determine your MAGI so you’ll have that information readily available when we connect in November.

Next Steps

I will be able to view 2026 plans and prices starting November 1st. I’ve included my scheduling link so you can begin scheduling a call with me or you can respond directly to the email.

If you have any questions, I am here to help! I look forward to connecting with you in November!